BRRRR Method: How Bridge Loans Pay Off

Categories: Blog Posts

Bridge loans on the front end are the key to successfully entering the BRRRR method.

BiggerPockets launched the BRRRR acronym a few years ago. BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. This acronym outlines a helpful strategy for successful real estate investing.

It centers around buying properties with built-in equity. After renovations, the investor can refinance therefore creating a sustainable cycle of investments.

Strategic Loans

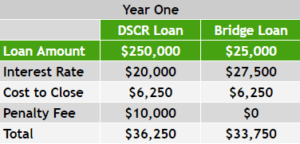

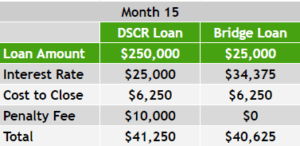

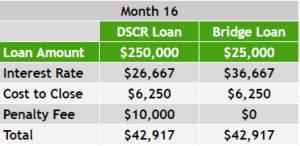

Instead of throwing a DSCR at the whole thing from the start, we suggest a different strategy of kickstarting your BRRRR cycle.

1. Start with bridge loans.

The BRRRR method is all about sustainable investing. How can you use other people’s money to keep cash flowing in and out of your projects?

This means beginning with a loan that’s going to cover those starting costs so you can get ownership and claim that equity! Bridge loans are perfect for this (especially if you get a private money loan).

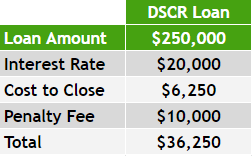

A bridge loan is more flexible than a DSCR so you can cover the purchase, rehab, even the closing costs.

2. Add the DSCR.

Once you’re actually starting to rent out the property, that’s the time for the DSCR. DSCRs have more restrictions anyways, so they’re most effective when used for renting.

The DSCR can pay off the bridge loan and you can refinance the property for an even better outcome.

The Beauty of the BRRRR Method

By using this loan strategy with the BRRRR method, we’ve worked with a client who was able to come up with a plan that should easily generate over $1,000/month of positive cash flow for himself.

And it all started with strategically using other people’s money to enter the BRRRR cycle.

This is the beauty of real estate investing. It’s accessible and profitable, even for beginners.

Read the full article here.

Watch the full video here: